Plant Insurance

Protect your business with owned or hired-in plant insurance through Jensten Insurance Brokers.

What is Plant Insurance?

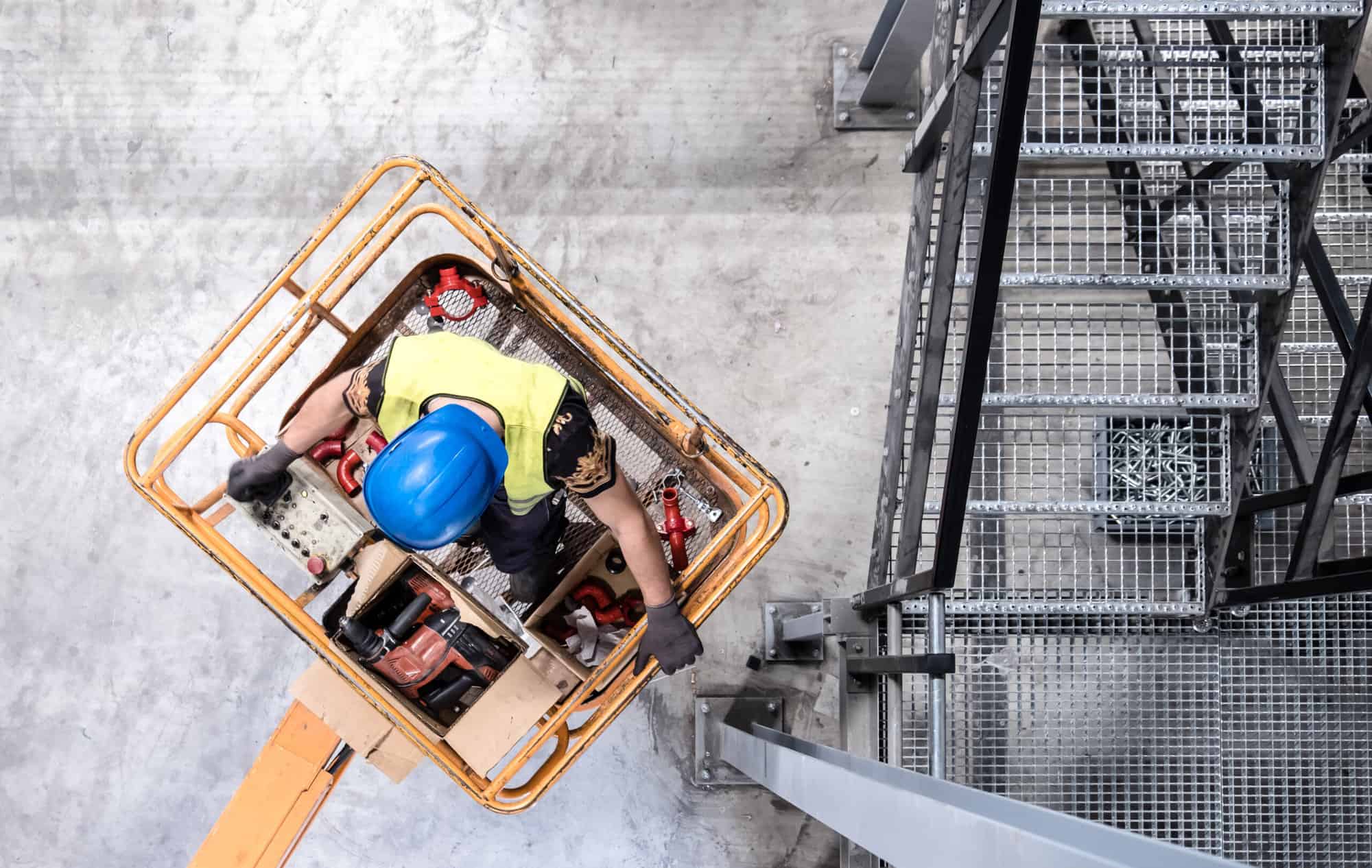

Plant Insurance is a special type of cover designed to protect construction, agricultural vehicles, and other specialist equipment such as forklifts, cherry pickers, diggers, and steam rollers.

It can cover your own equipment (owned plant) and ones you hire (hired-in plant) for use on-site and on public roads. A policy can be extended to include business-critical covers such as Public Liability, Employers’ Liability, and several other protections, making it useful for businesses using these machines.

If you’d like some Plant Insurance advice, or a plant insurance quote, then call Jensten Insurance Brokers on 0115 672 5661 or start your quote today.

Why use Jensten

Dedicated

Dedicated team of Plant Insurance specialists

Trusted

By thousands of Plant Insurance clients

Flexibility

Cover tailored to your individual needs

Talk to our specialists

Online

Start your quote at a time that suits you.

Phone

Call and let us find you the cover you need.

FAQs

Get the answers to frequently asked questions.

What our clients say...

Highly recommended, service is always excellent.

Easy to arrange. Friendly and competent staff. Good value.

Super efficient. Highly recommend.

The best rate combined with responsive service. Very good.

Rated 4.7/5 based on 781 reviews on

Need Plant Insurance?

Find out what covers businesses like yours need.

Plant Insurance

Plant Insurance can be a complex area of cover, so to help you get the protection you need, here are our frequently asked questions. We hope they are of use, but if you’d like some independent advice, please call us on 0115 672 5661, and the team will be happy to help.

It depends. If you want to drive it on the road, you will need a road risk element in your Plant Insurance.

Plant Insurance offers you flexible, specialist protection against a range of risks on a single policy. Whether you need an Owned or Hired-in Plant Insurance policy, it can protect your equipment from theft, loss, and accidental damage and allow you to drive it on public roads.

Yes, you just need it to be part of your policy.

That will depend on things like the size of your business, whether you have any employees, where you are working, the work you’re doing, your business’s postcode, and your claims history. For a tailored plant insurance quote, please call us on 0115 672 5661, and the team will be happy to help.

For something to be classed as a plant vehicle, it will need to specify that on the logbook.

There are many ways you can potentially get cheaper Plant Insurance quotes. These include comparing quotes – or getting an insurance broker to do the search and comparison for you, use a specialist independent broker who can save you from taking out covers you don’t need, secure your equipment, limit the number of drivers, and pay annually.

Yes, and some of the most common include:

- Public liability

- Contract works

- Employers’ liability

- Stock and materials

- Professional indemnity

- Third-party working risks

Articles and Insights

- 26 Apr

Revamp of MIB Services: Buckle Up for Exciting Changes!

- 24 Apr

Mastering Health & Safety Risk Assessments: Your Guide to a Safer Workplace

- 24 Apr

Unlock the Power of Safety: The Benefits of Proper Health and Safety

- 24 Apr